January 2024 Newsletter

Legal Lines News

Estate Planning and Elder Law

January 2024

Massachusetts Estate Tax

This newsletter highlights Federal Estate Tax. In addition to the Federal Estate Tax Exemption, we also have a Massachusetts Estate Tax. Our Massachusetts exemption was recently increased to $2M. This increase recognizes the jump people have in the value in their real estate in the Commonwealth. Despite market slow down the values are holding to a significant degree. For example, if you own a home and it is valued at $1.7M, it plus your assets could put you over the $2M threshold and there would be a Massachusetts estate tax even if there is no federal estate tax. The tax rate on assets where there is more than $2M counts from the first dollar, and could be between four and sixteen percent. So, planning should be considered.

There is another consideration for Massachusetts residents in the $2M-5M estate bracket. That is how the cost of a need for longterm care can impact these estates, and what to do about it. We at Lannik Law have a specialty in the area of “elder law” and are able to assist clients with planning that not only deals with estate taxes, but also considers and helps to manage longterm care costs. Most people who visit us are shocked to learn that RELIABLE care at home may cost between $48,000-$60,000 per year more; care in an assisted living facility can cost up to $11,000 per month or $132,000 per year; and skilled nursing care can run ups to $18,000 per month or $216,000 per year. The average stay in a facility is now up to about four years. Thus the fee for one person in s nursing home would be $864,000 and for two $1,728,000. We can help ameliorate these costs by proper planning. Although planning should be done before the catastrophe hits, we have many clients that wait too long and we can assist some of them as well. We do urge you to seek our guidance, counsel and planning sooner rather than later for the best result in saving your estate.

The Countdown Begins: Will We Keep the $10 Million Exemption?

The Tax Cuts and Jobs Act significantly increased the federal estate tax exemption to $10 million adjusted for inflation. However, the countdown has begun for the potential sunset of this generous exemption by the end of 2025. Read more to learn about the history and potential future of the estate tax exemption.

Case Study: How Concerned Should You Be About Estate Tax Issues?

If you have significant wealth, you may be exposed to future estate tax burdens that must be acted on before the Tax Cuts and Jobs Act reduces the estate tax exemption in 2026. Read more to explore estate planning and tax considerations you should be thinking about.

If You Own Any of These, You Need to Watch Their Value

At the end of 2025, the $10 million, adjusted for inflation, estate tax exemption may revert to the pre-2017 exemption amount, cutting it almost in half. Read more to find out the accounts and property you need to pay close attention to.

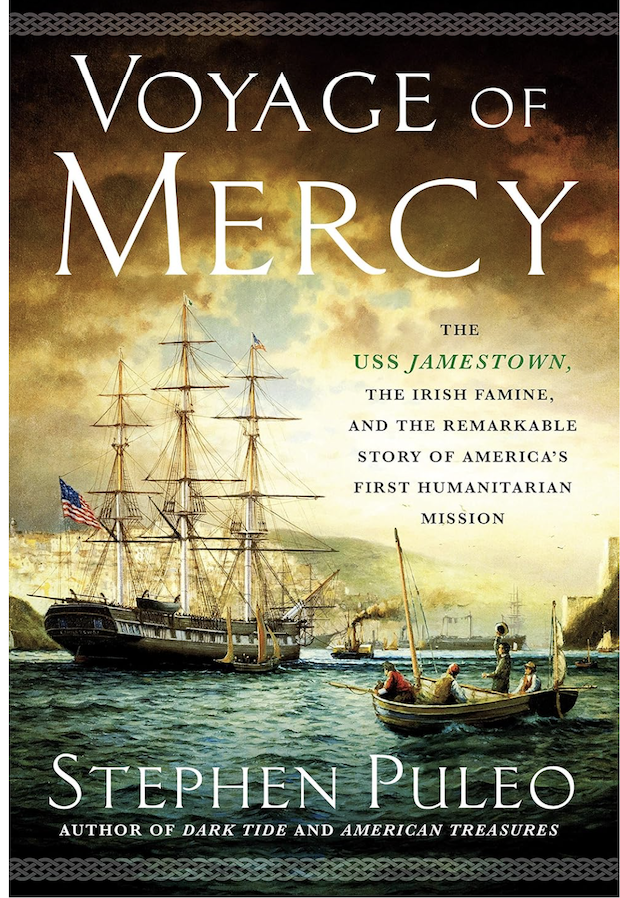

Susana’s Book Review

Voyage of Mercy by Stephen Puleo

A very interesting book. It is really a story of US philanthropy as it started in the 1800s. Captain Robert Bennet Forbes convinced the US government to outfit the Jamestown (an American war vessel) so that it could be filled to the brim with food to help the Irish during the potato famine. This act of philanthropy eventually set the stage for further assistance through public (US) private partnerships/sponsorships that the US and its citizens engage in even today. There is no model in the world like this. So country helping foreign country is very American. As a result of this act and others that have followed, we Americans whether we choose to exercise the philanthropy towards others or not, are all born with the philanthropy instinct in our national DNA. The “art of giving” has grown in the US since Forbes made it his business to help the Irish. There are ways to give that are even tax advantaged today. If you want to “gift” to your loved ones or your favorite charity, let us know so we may work this important goal into your estate planning. In the meantime read the book!